Small percentages, massive impact.

In crypto, many investors love to hold (HODL) — buy assets and wait patiently. It’s simple, low-maintenance, and historically profitable for major coins like BTC and ETH.

But what if we told you that just a 1% difference in APY could dramatically change your wealth curve over the long term? This is where staking steps in. While holding keeps your portfolio static, staking allows your assets to quietly compound behind the scenes, boosting returns without extra effort.

Let’s break down the difference between holding and staking, why APY matters, and how even a tiny boost can reshape your financial future.

What Is APY?

APY = Annual Percentage Yield

It measures how much you earn on your crypto in one year — factoring in compound interest. In simple terms: APY shows how fast your money grows when profits are automatically reinvested.

Example:

- If you stake BTC at 5% APY, your BTC grows 5% over a year — compounded automatically.

The formula behind APY includes compounding frequency.

Holding vs Staking: What’s the Difference?

✅ HOLDING

- You simply keep your coin in a spot wallet

- Profits rely ONLY on price increases

- No additional yield

Holding is safe and simple, but your tokens remain idle.

✅ STAKING

- You lock or subscribe your token into an earning product

- Earn passive rewards on top of price appreciation

- Benefit from compounding

It gives you the upside of holding + passive yield, without needing to trade.

Why 1% APY Matters More Than You Think

You might think 1% is insignificant, but compounding changes everything. Let’s compare:

| Investor | Method | APY | Starting Balance | 5-Year Result |

|---|---|---|---|---|

| A | Holding only | 0% | 10,000 USDT | 10,000 USDT |

| B | Staking | 1% | 10,000 USDT | 10,510 USDT |

| C | Staking | 5% | 10,000 USDT | 12,763 USDT |

Even at 1% APY, Investor B earns >500 USDT more in 5 years — with zero additional risk or work.

At 5% APY, Investor C earns over 2,700 USDT more than a pure holder.

It’s the power of compounding. The longer you stake, the more you earn, even if the APY difference is small.

If BTC or ETH appreciates while you stake it, you earn from both:

- Asset price increase

- Staking yield

This dual engine accelerates your wealth curve faster than holding alone.

Asides, here is another example:

Imagine two BTC holders starting with 1 BTC:

| Year | Holder: 0% APY | Staker: 4% APY |

|---|

| 1 | 1.0000 | 1.0400 |

| 3 | 1.0000 | 1.1249 |

| 5 | 1.0000 | 1.2167 |

After 5 years, the staker earns 0.2167 BTC more, just by staking.

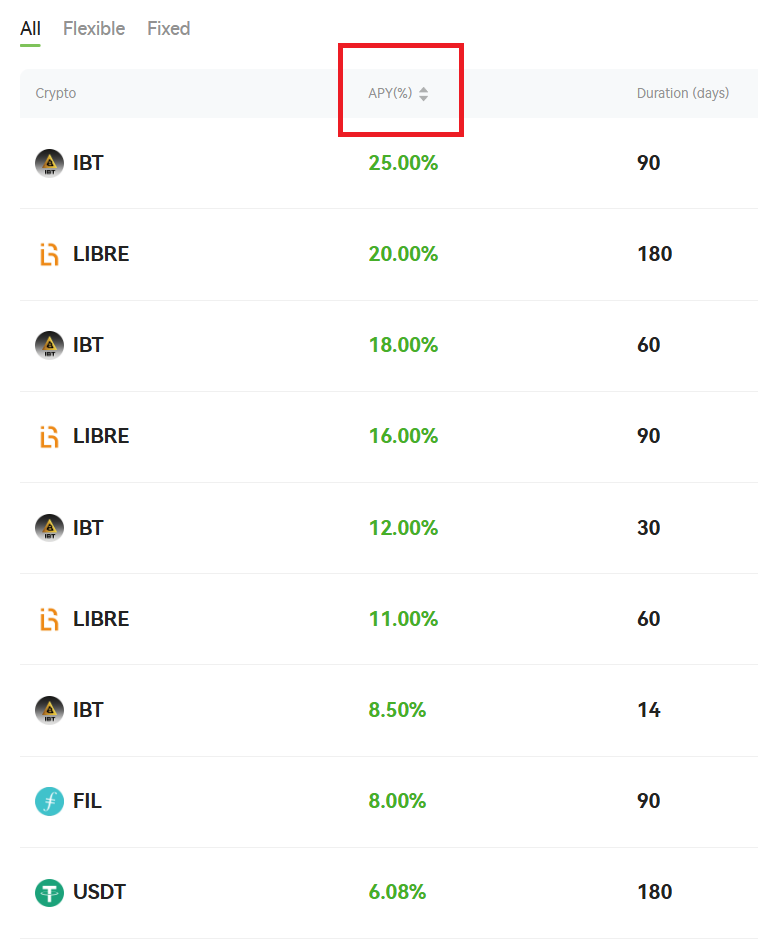

How to Start Staking on Hotcoin

- Open Hotcoin App

- Tap More → Earn

- Choose Flexible/Fixed product

- Subscribe & start earning

Daily yield → Auto-compound → Passive growth

That’s it.

Staking isn’t complicated, it’s smart.

If you believe in your assets long term, why let them sit idle?

Hotcoin Earn — Earn more by doing less.

Hotcoin Official Site: https://www.hotcoin.com

Hotcoin Twitter: https://x.com/HotcoinGlobal

Hotcoin Telegram: https://t.me/HotcoinEX

Hotcoin Chinese Twitter: https://x.com/hotcoinzh

Hotcoin Chinese Community: https://t.me/hotcoinglobalcn

Hotcoin YouTube: https://www.youtube.com/@hotcoinglobal